We all have basic needs; Food, water, clothing, shelter.

Most of us also have wants; cable TV, dining out, vacations, a tempurpedic bed, etc.

These things are pretty black and white. But there is a rather large gray area in between. In the gray area one family’s wants are another family’s needs.

If we look at this on a global scale it becomes obvious. Here in the United States running water and electricity are considered needs, while in many parts of the world they’re wants. Make sense?

This gray area is where a family’s budget lives or dies. Figuring out the priorities for items in your gray area can help you create a better, more realistic budget for your family.

So let’s dive in!

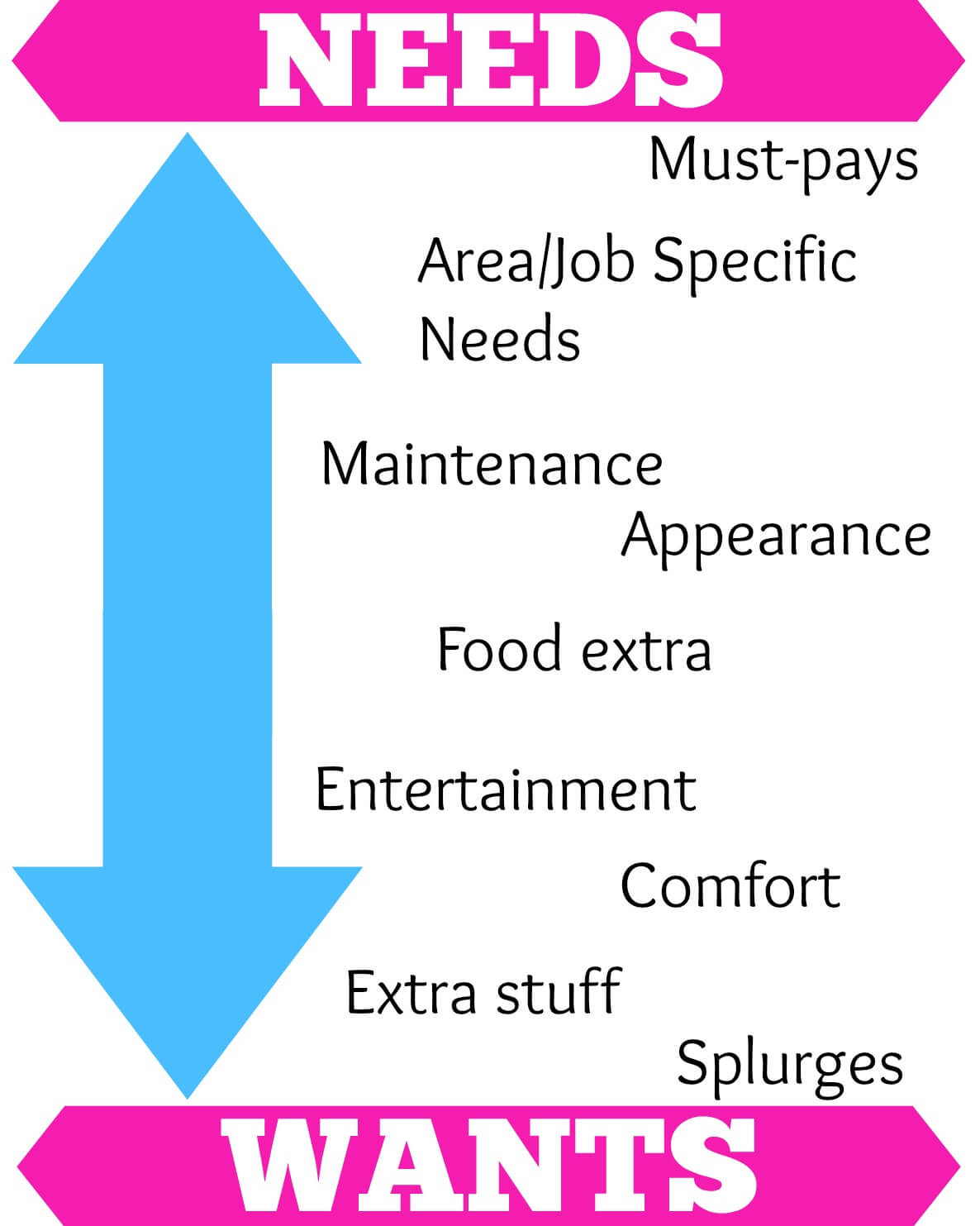

I like to break things into categories – it makes it easier for me to see the big picture – then fill in each category.

Must-pays. These are items you must pay for in order to meet your basic needs. Your mortgage, heating bill, and groceries fall into this category. If you’re a double-income family with kids, this category would also include childcare. Also, if you don’t have employer-sponsored health care, that would be a must-pay.

Area/Job-specific needs. I live in the suburbs. Zillow gives my house a walkability score of 3 (out of 100), which means we need a car. As a teacher and a blogger, a computer and internet access is essential. Think about how where you live and what you do affects what you consider needs.

Maintenance. Your home, car, power tools, washer & dryer, kitchen appliances, and yard need to be maintained to make them last longer.

Appearance. Yes, you need clothing, but clothing means different things to different people. Do you have a uniform? Do you work in a professional setting, or a casual one? Do you work from home? Some jobs require certain grooming (i.e. flight attendant), some jobs have very loose dress codes. And don’t forget haircuts and other details that may be expected in your field.

Comfort. My recliner where I sit to do my writing. The gorgeous wood carving for our stairway. A new mattress. These things are not essential for life, but they make it a lot more comfortable. Also in this area, a maid or other service that makes my life easier.

Entertainment. I tend to put more of an emphasis on things to do at home, like Miss O’s play area and cable TV, than things outside the home like travel, because I’m a homebody. Others would rather go without cable so they can afford to take lots of trips.

Food extras. Things like dining out, fast food, Dunkin Donuts, etc. would go here. Also, that leg of lamb that’s on sale but completely unnecessary. Chocolate and other sweet treats, snacks (especially individually wrapped), and flavored coffee creamers.

Extras of anything. Most of us have more than enough things, yet we continually buy more. I have enough pairs of shoes, but I’ll buy another if they’re cute and a decent price. Heaven knows Miss O has more than enough clothing, but that doesn’t stop me from getting her more. How many bottles of lotion do you have in your cabinet? If the answer is more than 1, you have extra.

Splurges. We recently bought a new tv for our bedroom. It was a splurge, but we used money we’d gotten for Christmas, which is money I don’t mind splurging with. I’ll occasionally go crazy and get myself a pedicure. Splurge. These are things that you can absolutely live without, they add minimal value to your life, but they feel good in the moment.

Here’s what all that looks like as we prioritize it:

How do we use this to set our budget?

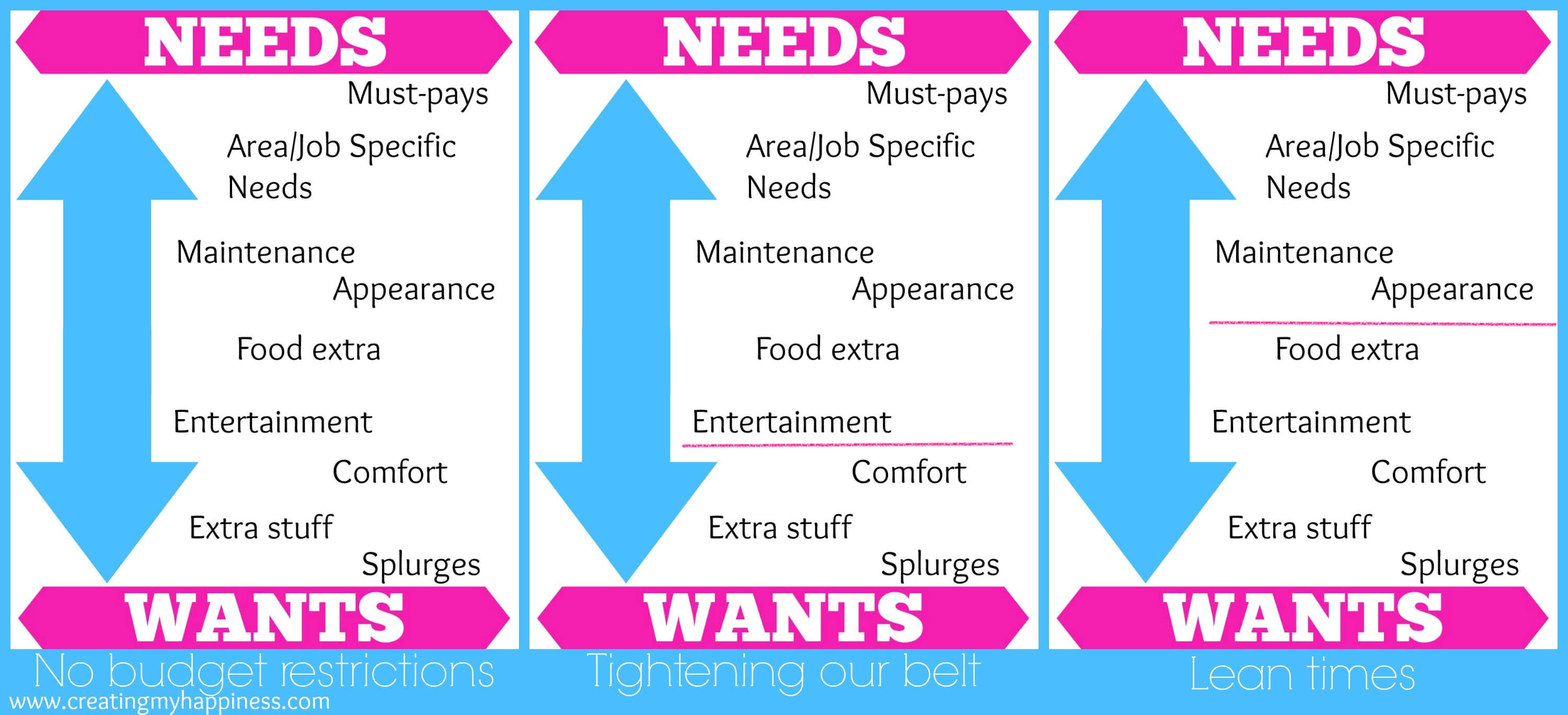

Basically, we fill in the chart with our expenses (or categories, as I do). The higher up the page, the bigger the priority, with the ones on the bottom getting the smallest part of our budget. If we have to reduce our budget, we draw a line on the chart. Anything below the line gets cut first.

Here’s an example of the same chart in 3 different budgetary situations:

On the left we have a budget with no restrictions. We’re earning enough money (after taxes and savings) to afford at least a little something in each category.

In the middle we have to tighten our belts a bit, so we have to cut out comfort items, extra stuff, and splurges and trim back on appearance, extra food, and entertainment.

On the right is our minimum budget. We cut everything except what we need to live and work. It’s workable, but we’d consider other options, like cheaper housing, if we had to sustain this budget for more than a couple of months.

This also helps us assess how our spending reflects our priorities.

Now you try!

Click here to download your own blank copy of the In-Between Spending Organizer.

Fill in your personal information. You can use my categories or be more specific. You can even fill in dollar amounts if you really want to get down to nitty gritty.

![6 Easy Ways to Find Balance Between Work and Motherhood [GIVEAWAY]](https://creatingmyhappiness.com/wp-content/uploads/2018/10/Finding-Balance-2-440x264.jpg)