Now that you’ve started thinking about how to start saving money, calculated how much you need in your emergency savings fund, and started making your retirement a priority, it’s time to set your priorities for where you’re going to put your money.

Let’s start with the categories. Everyone has their own way of setting up their savings – and I’ll get into creating a digital envelope system next week – but here are the categories I use for my savings system:

Emergency Savings – This is the savings you hide away for a rainy day. Most experts say your emergency fund should cover 6-12 months worth of expenses for your household (both incomes if you’re a 2-income family).

Upcoming Expenses – Do you have an insurance policy that you pay once or twice a year? Direct your money automatically to a savings account so it’s there when you need it. Our boiler is 30 years old and is going to need to be replaced soon. We’re saving up so that when it happens we won’t be thrown for a financial loop.

Retirement – Your retirement account is what you’re going to live off of when you stop working. The more money you put away now, the earlier you can retire and the higher your standard of living will be when you do. Remember, there are no loans for retirement!

College – If you have kids you’re most likely thinking about college. It’s a huge expense and it’s becoming less of an option for many careers.

Future Needs/Wants – Are you going to buy a new (to you) car someday? Do you want to redo the bathroom? These are things that are better saved for than financed.

Fun Stuff – We’re saving for a Disney vacation. It’s going to take a while, but that’s okay. In the mean time we put away money for weekend getaways, gifts, and special occasions. We could live without these things, but these smaller, fun goals help us stay focused and keep our eyes on the prize.

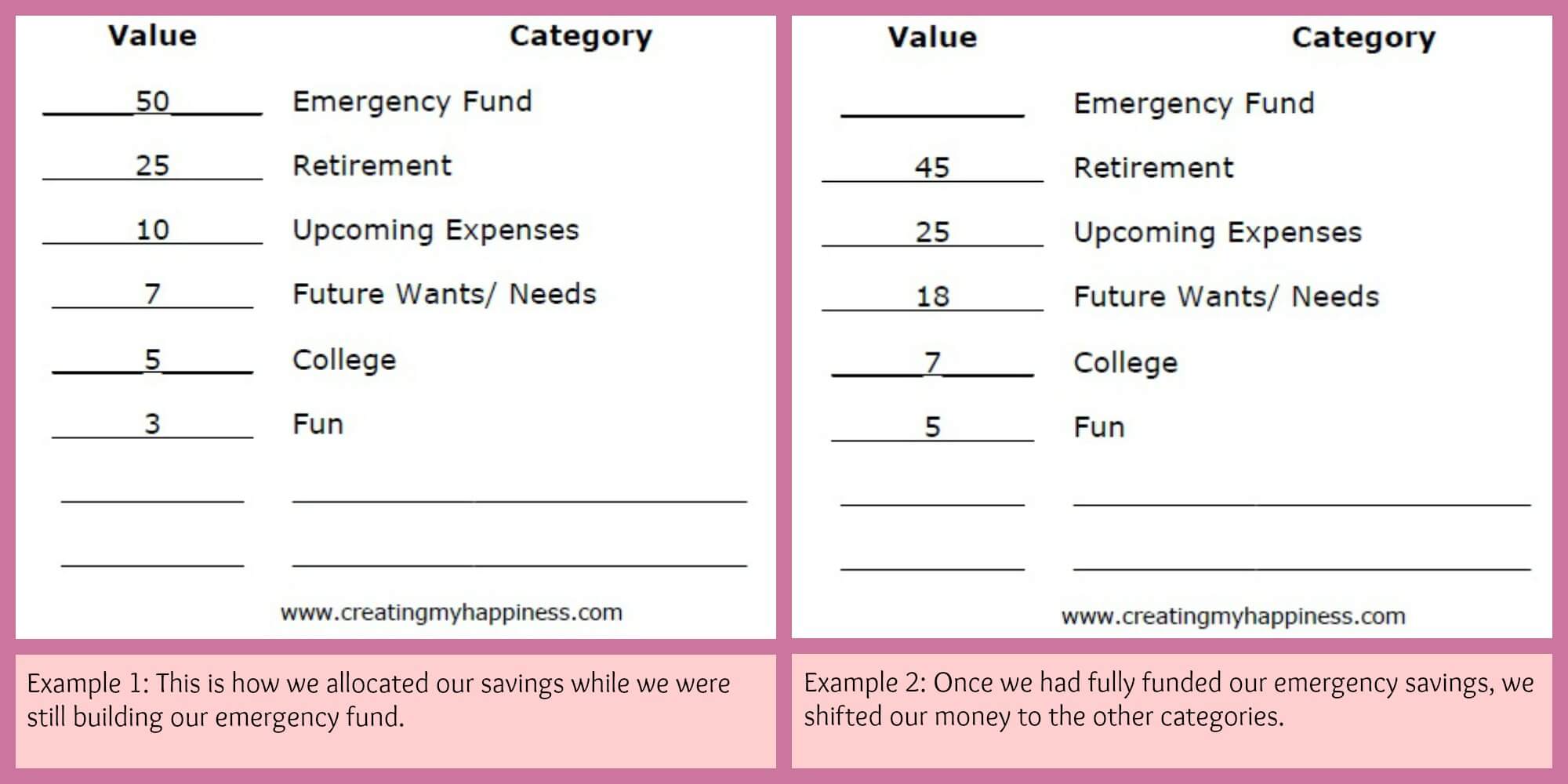

Next is what to do with these categories. How do you determine how much to set aside for each category? Again, that’s going to be different for every person, but here’s what I do.

The number in the left column is the percentage, not a dollar figure. However much you can devote to savings each month, assign the percentage of that amount to the category. If you have $80 a month 50% = $40, 25% = 20, 10% = 8, etc. For trickier numbers, multiply the total amount by the percentage (25% = .25).

While we were building our emergency fund we made that a priority. Now that it’s fully funded (and earning interest!) we’ve shifted our funds to other areas.

Starting to save can be overwhelming and intimidating. The key is to start small. Remember that every little bit helps and it’s going to take a while to reach your goals. Don’t let slow progress become no progress.

Click here to get my printable worksheet to help you set your priorities and grow your savings!

How do you split up your savings? Share in the comments.

Linked up at One Project at a Time, Thrifty Thursday, Frugal Friday, Financially Savvy Saturday