Nobody likes to think about what would happen if their income suddenly disappeared or was drastically cut. But not planning for such a scenario can make a bad situation worse. Taking steps to plan and save now can literally save your financial future. It’s that important.

But how much do you need?

Different financial experts have different recommendations, but generally it’s between 6-12 months worth of expenses. Expenses should include everything you spend your money on. I suggest you base this number on your current spending, not what you think you could live without. You can always cut more from your budget if you need to, but too much savings is better than not enough.

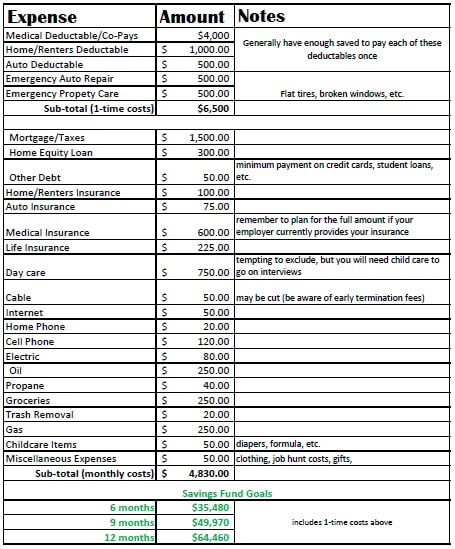

A complete emergency fund should cover your regular monthly expenses, plus any incidental things that come up and can’t be avoided (i.e. emergencies). You need to be able to pay your mortgage, insurance, utilities, and other bills, as well as pay for food, gas, and other basic needs.

The chart below includes common monthly expenses for a typical US family. (Don’t worry about the dollar amounts – I made them up – the actual amounts will vary greatly depending on where you live and what your income is.) I’ve broken expenses down into one-time events, like needing new tires or medical treatment, and monthly expenses like the mortgage or rent. For occasional expenses, like heating oil, I figured about how much we have to save each month to be able to pay the bill when it comes in. I like use a digital envelope system for these expenses.

Is that a lot of money? Yes. Is that an overwhelming amount of money? Probably. Is it necessary? Absolutely.

When we first started our emergency fund, it was hard to see such a large number and such slow progress towards our goal. But ever so slowly the amount in our account started to build up. Eventually we got a point where it actually made us giddy to look at our balance. After a while we delighted in staying in for dinner and putting more money into our savings. Bonus: when we actually needed our emergency fund, we were already so financially disciplined that we used very little of our savings!

And while thinking about trying to save that much money is intimidating, you’re never going get there if you don’t get started. Rome wasn’t built in a day and your emergency fund won’t be either. The most important thing is that you make saving a priority and that you stick with it.

Need some help getting started? Here are some resources for you:

6 Steps to Start Saving Money

A Step-By-Step Guide to Building a Big, Healthy Emergency Fund from A Simple Dollar

How to Start an Emergency Fund from Frugal Living

And here’s the biggie. Just for you, no strings attached, I have put together a downloadable Excel file to help you figure out how much you need in your emergency savings account. Click here to download (there’s also a printable version if you don’t have Excel), and start plugging in your expenses. The math will be done for!